Embark on the journey of Sustainable Budgeting: Spending Less While Living More, where financial wisdom meets a fulfilling lifestyle. This topic delves into the art of making the most out of your resources while enjoying a richer life experience.

Importance of Sustainable Budgeting

Sustainable budgeting is a financial planning approach that focuses on long-term financial health by balancing income and expenses while considering environmental and social impacts. It involves making conscious spending decisions to ensure financial stability not only for the present but also for the future.

Examples of how sustainable budgeting can improve financial health

- By tracking expenses and setting realistic budgets, individuals can avoid overspending and accumulate savings for emergencies or future investments.

- Reducing unnecessary expenses such as dining out frequently or impulse shopping can free up funds to pay off debt faster and increase overall financial well-being.

- Investing in sustainable products or services can lead to long-term cost savings and contribute to a more environmentally friendly lifestyle.

Benefits of spending less but living more through sustainable budgeting

- Increased financial security: Sustainable budgeting allows individuals to build a financial cushion for unexpected expenses or emergencies.

- Reduced financial stress: By managing finances wisely and living within means, individuals can experience less anxiety about money matters.

- Improved quality of life: Spending consciously on experiences and items that truly matter can lead to a more fulfilling and meaningful life, despite spending less overall.

Strategies for Spending Less

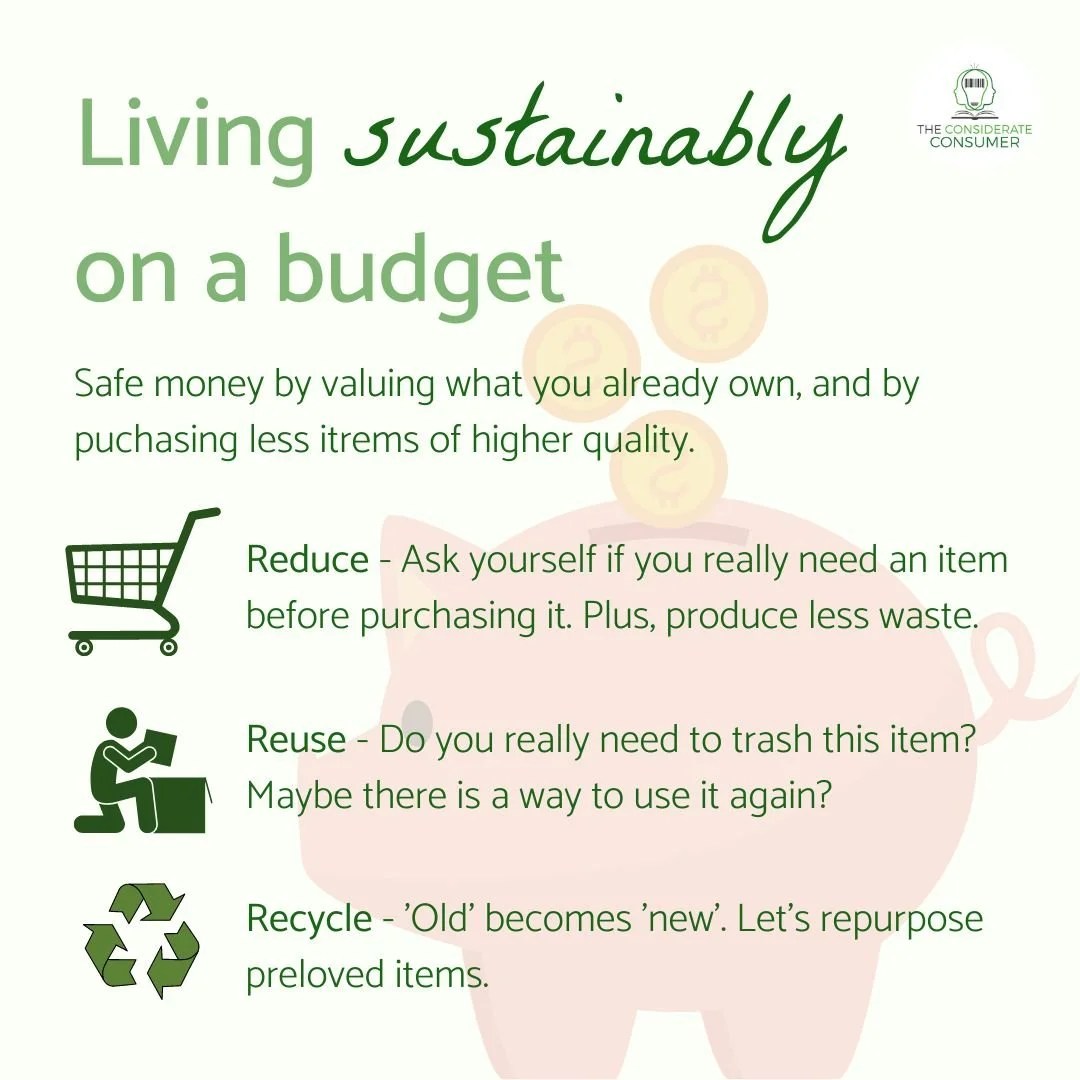

In order to achieve sustainable budgeting, it is crucial to implement strategies that help in reducing expenses without compromising the quality of life. By distinguishing between needs and wants, setting financial goals, and making conscious spending decisions, individuals can effectively manage their finances and live a more fulfilling life.

Distinguishing Between Needs and Wants

One of the key strategies for spending less is to differentiate between needs and wants. Needs are essential for survival and include expenses such as food, shelter, and healthcare. On the other hand, wants are non-essential items that may bring temporary satisfaction but are not necessary for basic living.

By prioritizing needs over wants, individuals can allocate their resources more efficiently and avoid unnecessary expenditures.

Setting Financial Goals

Another important aspect of sustainable budgeting is setting clear financial goals. By establishing specific objectives, such as saving for a vacation, purchasing a home, or building an emergency fund, individuals can stay motivated and focused on their long-term financial well-being.

Setting realistic and achievable goals helps in making informed spending decisions and ensures that resources are allocated effectively.

Living More with Less

Living more with less is about shifting our focus from acquiring material possessions to prioritizing meaningful experiences that bring joy and fulfillment to our lives. Embracing minimalism plays a significant role in sustainable budgeting as it encourages a simpler lifestyle that reduces unnecessary expenses and clutter, allowing us to allocate resources towards what truly matters.

Impact of Minimalism on Sustainable Budgeting

Minimalism promotes intentional living by decluttering our physical spaces, our minds, and our schedules. By embracing a minimalist mindset, we become more mindful of our consumption habits, leading to reduced spending on unnecessary items. This shift allows us to save money, live within our means, and prioritize experiences that enrich our lives.

Examples of Simplifying Life for Greater Happiness

1. Experiences Over Possessions

Instead of buying the latest gadgets or fashion trends, invest in travel, quality time with loved ones, or pursuing hobbies that bring you joy

2. Decluttering

Clearing out excess belongings not only creates a more organized living space but also reduces the urge to make unnecessary purchases.

3. Mindful Consumption

Before making a purchase, consider if the item adds value to your life or if it's just a fleeting desire. This practice helps in avoiding impulse buying and focusing on long-term satisfaction.

Building an Emergency Fund

Having an emergency fund is a crucial component of sustainable budgeting as it provides a financial safety net for unexpected expenses or income disruptions. It helps prevent the need to rely on credit cards or loans, which can lead to debt accumulation.

Starting and Growing Your Emergency Fund

- Start small: Begin by setting aside a small amount from each paycheck to gradually build up your emergency fund.

- Automate savings: Set up automatic transfers from your checking account to a separate savings account dedicated to your emergency fund.

- Cut unnecessary expenses: Review your budget to identify areas where you can reduce spending, and allocate those savings to your emergency fund.

- Set realistic goals: Aim to save at least three to six months' worth of living expenses in your emergency fund.

Tips for Handling Unexpected Financial Challenges

- Assess the situation: Evaluate the severity and urgency of the financial challenge to determine the best course of action.

- Prioritize essentials: Focus on covering basic needs such as housing, food, and utilities before addressing other expenses.

- Explore alternative solutions: Look for ways to generate additional income or negotiate payment plans with creditors to manage the financial challenge effectively.

- Stay adaptable: Be prepared to adjust your budget and spending habits temporarily to navigate unexpected financial setbacks without compromising your long-term financial goals.

Final Summary

In conclusion, Sustainable Budgeting: Spending Less While Living More offers a roadmap to financial stability and a more meaningful existence. By prioritizing smart spending and value-driven choices, one can truly embrace a life of abundance while keeping a tight rein on expenses.

FAQ Section

How can sustainable budgeting improve financial health?

By fostering a mindset of conscious spending, sustainable budgeting helps individuals track their expenses, prioritize needs over wants, and ultimately build a secure financial future.

What role do financial goals play in achieving sustainable budgeting?

Setting clear financial goals provides a roadmap for budgeting success, guiding individuals towards smart spending decisions and long-term financial stability.

How does minimalism impact sustainable budgeting?

Minimalism encourages a simpler lifestyle focused on experiences rather than material possessions, aligning perfectly with the principles of sustainable budgeting that emphasize value over excess.

Why is having an emergency fund essential for sustainable budgeting?

An emergency fund acts as a financial safety net, protecting individuals from unexpected expenses and ensuring that their budget remains intact even in times of crisis.

How can one handle unexpected financial challenges without disrupting their budget?

By diligently maintaining an emergency fund, reducing unnecessary expenses, and staying committed to financial goals, individuals can navigate unexpected financial hurdles without compromising their overall budgeting strategy.